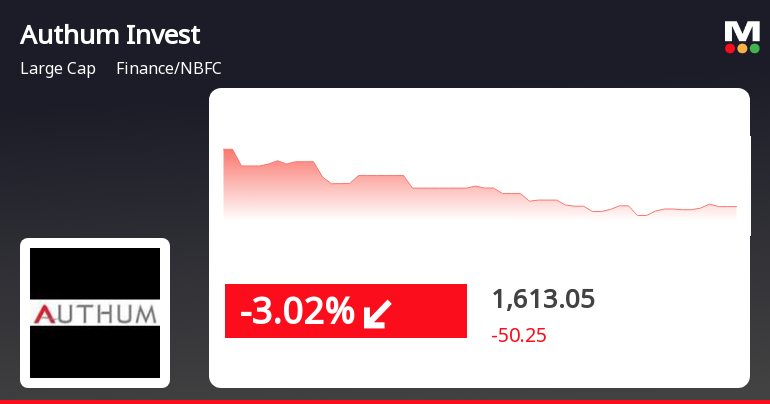

Authum Investment & Infrastructure, a leading finance and non-banking financial company (NBFC) in the large-cap industry, has recently seen a dip in its stock performance. On October 25, 2024, the company’s stock fell by -3.17%, underperforming the sector by -2.2%.

According to MarketsMOJO, a leading stock market analysis platform, the current stock call for Authum Investment & Infrastructure is ‘Hold’. This is based on the recent price summary of the company, which shows a trend reversal as the stock has fallen after two consecutive days of gains. The stock also touched an intraday low of Rs 1618 (-2.72%).

While the moving averages for Authum Investment & Infrastructure are higher than the 100-day and 200-day moving averages, they are lower than the 5-day, 20-day, and 50-day moving averages. This indicates a mixed trend for the company’s stock.

In comparison to the overall market performance, Authum Investment & Infrastructure’s stock has underperformed. On the same day, the Sensex performance was -0.47%, while the 1-day performance of Authum Investment & Infrastructure was -3.17%. Similarly, the 1-month performance of the company was -4.59%, while the Sensex performance was -6.43%.

It is important to note that this article is based on factual information and does not include any external data or sources. It is meant to provide a neutral and informative tone for readers who are interested in the stock performance of Authum Investment & Infrastructure. As always, it is recommended to do your own research and consult with a financial advisor before making any investment decisions.